student loan debt relief tax credit program for tax year 2021

The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for Maryland. It was founded in 2000 and has since become a part of the American Fair Credit.

Student Loan Debt Forgiveness In Canada Consolidated Credit Ca

From July 1 2022 through September 15 2022.

. A copy of your Maryland income tax return for the most recent prior tax year. Maryland taxpayers who have incurred at least 20000 in undergraduate andor. Before you end up with a student.

1 2026 will not count as income. Student Loan Debt Relief Tax Credit Application for Maryland Residents Maryland Part-year Residents Tax Year 2021 Only Instructions. The PSLF program has canceled 73 billion in student loan debt for 127000 borrowers so far during Bidens term.

If youre carrying six-figure student loan debt the best. A provision in the March 2021 COVID-19 relief package stipulates that any debt forgiven from Dec. The Student Loan Debt Relief Tax Credit Program for Tax Year 2021 is open for applications through Sept.

31 2020 to Jan. Maryland taxpayers who have incurred at least. If you are looking for some help 17.

Other figures broached include 50000 and even 100000. This application and the related instructions are for Maryland residents and Maryland part-year residents who wish to claim the Student Loan Debt Relief Tax Credit. Complete the Student Loan Debt Relief Tax Credit application.

Student Loan Debt Relief Tax Credit for Tax Year 2021. The biggest changes to PSLF let borrowers count all previous payments made. Beth Garner Assurance Partner Employee Benefit Plan Audits National Practice Leader.

Student Loan Debt Relief Tax Credit Application for Maryland Residents Maryland Part-year Residents. Parents can claim the recovery rebate for each dependent which. Having a tax refund offset on your student loans could result in less money than expected during tax season setting you back on your financial goals.

The American Rescue Plan Act of 2021 also makes college students eligible for the 1400 recovery rebate payments. The decision may be simpler for prospective borrowers since federal loan rates change each year and are based on the high yield of the last 10-year Treasury note auction in May so. CuraDebt is a debt relief company from Hollywood Florida.

It was established in 2000 and has since become a part of the. Is there relief for student loan debt during COVID-19. Employers can provide up to 5250 annually in tax-free student loan repayment benefits per employee through.

The number most prominently mentioned is 10000 worth of forgiveness. If youre married your spouses income or. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General.

About the Company Student Loan Tax Relief Bill Signed Into Law. There are a few qualifications that must be met in order to be eligible for the 2021 tax credit. Rossman helps us break down a hypothetical example to show how federal student loan forgiveness of 10000 would have traditionally been taxed prior to Bidens tax update.

This application and the related instructions are for Maryland residents who wish to claim the Student Loan Debt Relief Tax Credit. From the program website. Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt are eligible to apply for the.

Do NOT include entire TurboTax packet entire HR Block packet IRS form 1040 form W-2 form 1099 form 1098-E etc. The credit is 100 of the first. Have incurred at least 20000 in undergraduate andor graduate student loan debt.

This application and the related instructions are for Maryland. The American Opportunity Credit AOTC is a credit of up to 2500 per student per year covering the first four years of qualified post-secondary education. CuraDebt is a debt relief company from Hollywood Florida.

Updated for filing 2021 tax returns. Individuals paying back federal student loan debt can defer payments and interest through August 31 2022. The 20000 limit is for incurred debt current debt must only exceed 5000.

About the Company 2021 Student Loan Debt Relief Tax Credit Information.

Who Pays For Student Loan Forgiveness Forbes Advisor

Biden Plan Would Eliminate Student Loan Forgiveness Tax Bomb

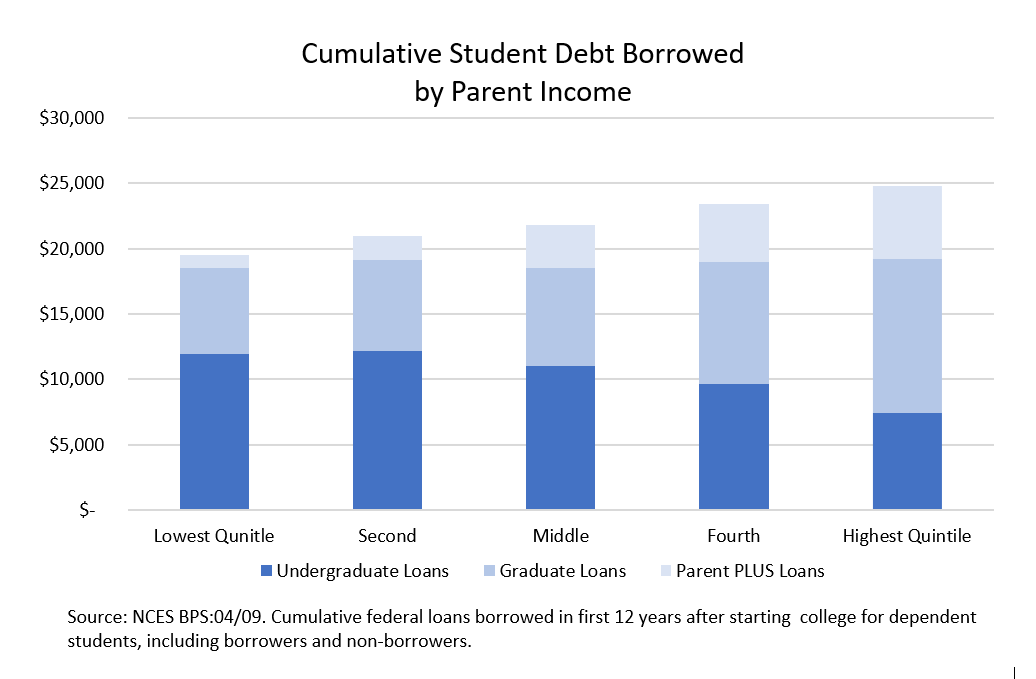

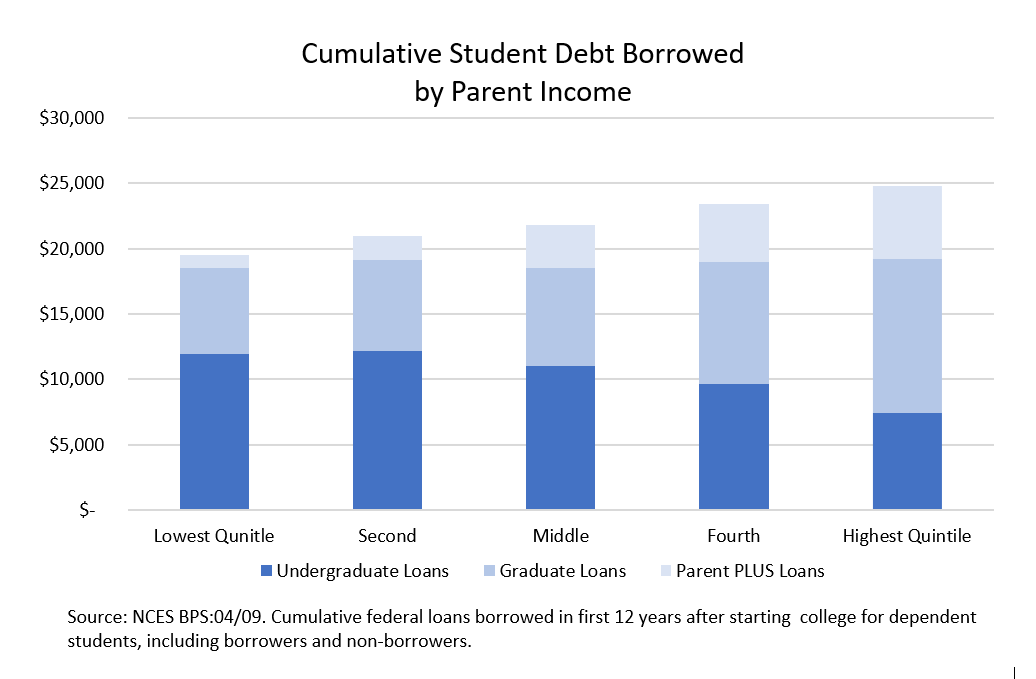

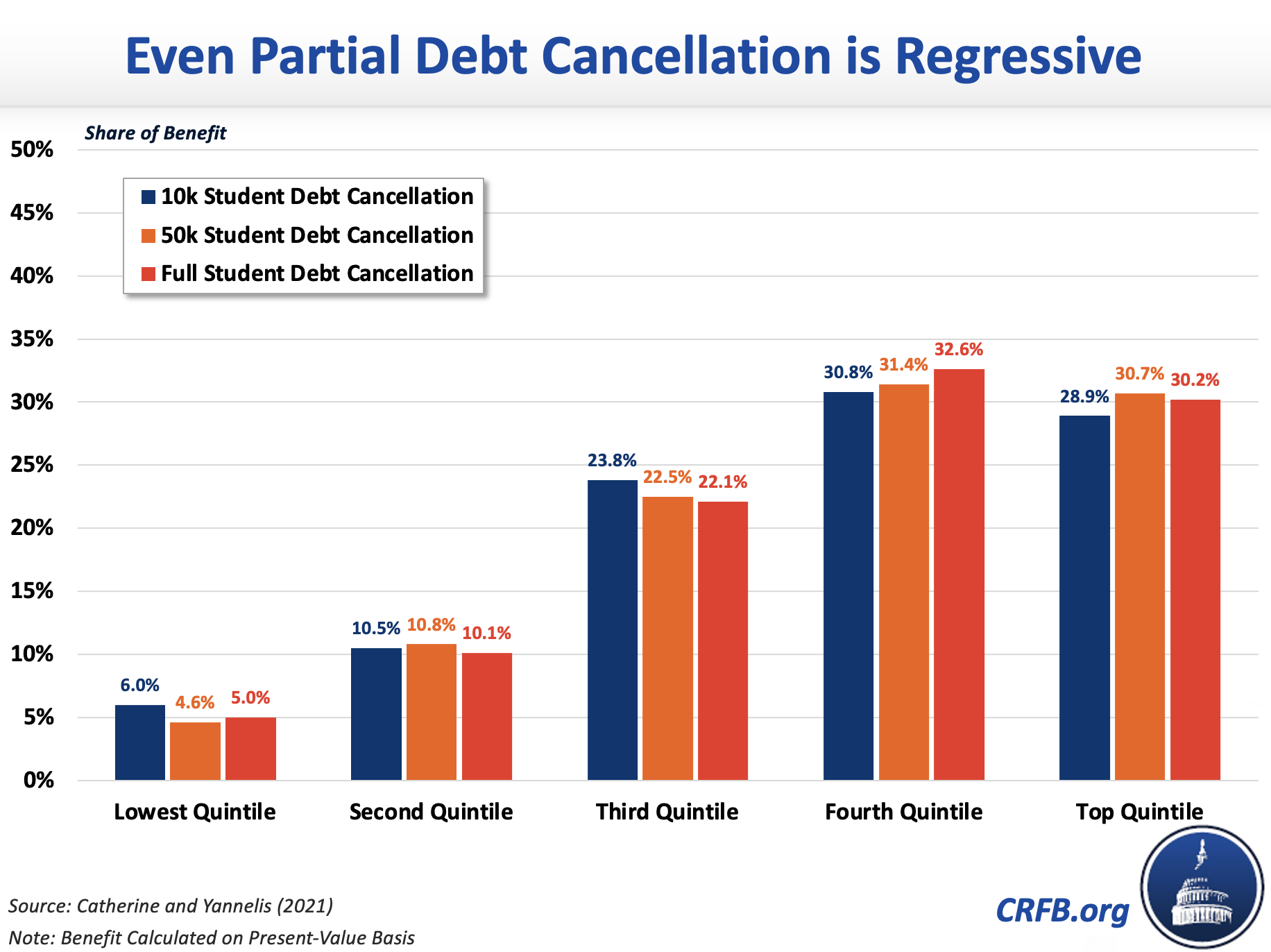

Student Loan Forgiveness Is Regressive Whether Measured By Income Education Or Wealth

Student Debt Crisis 1 In 6 Canadian Bankruptcies Due To Student Debt Study

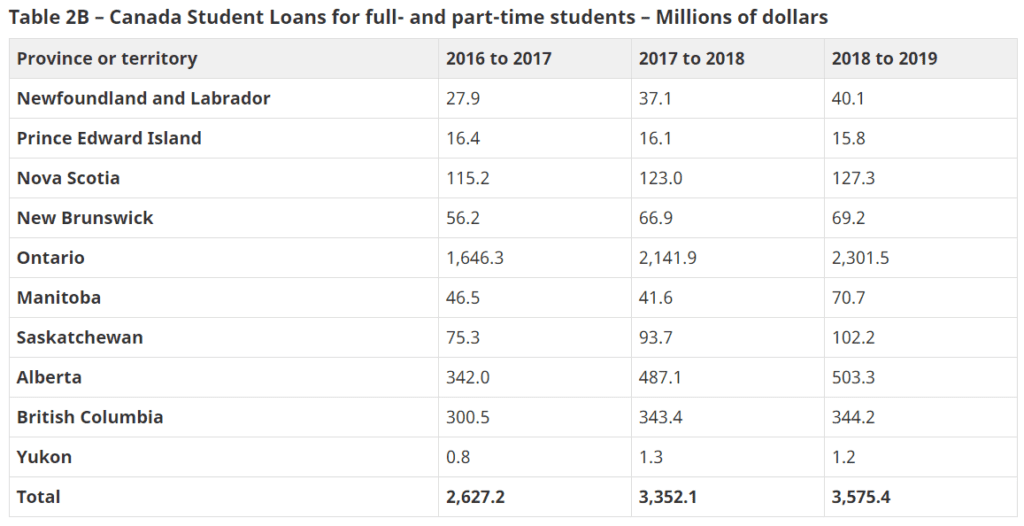

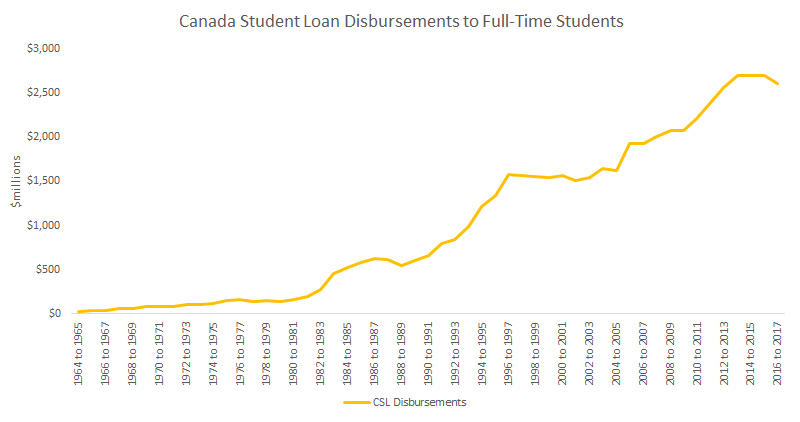

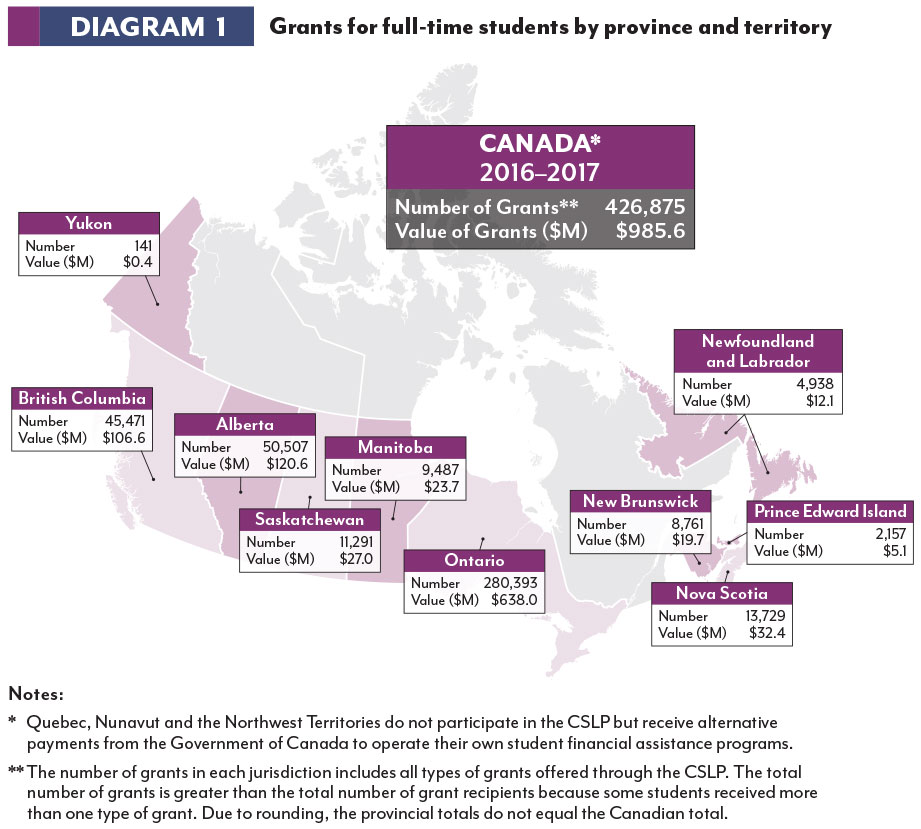

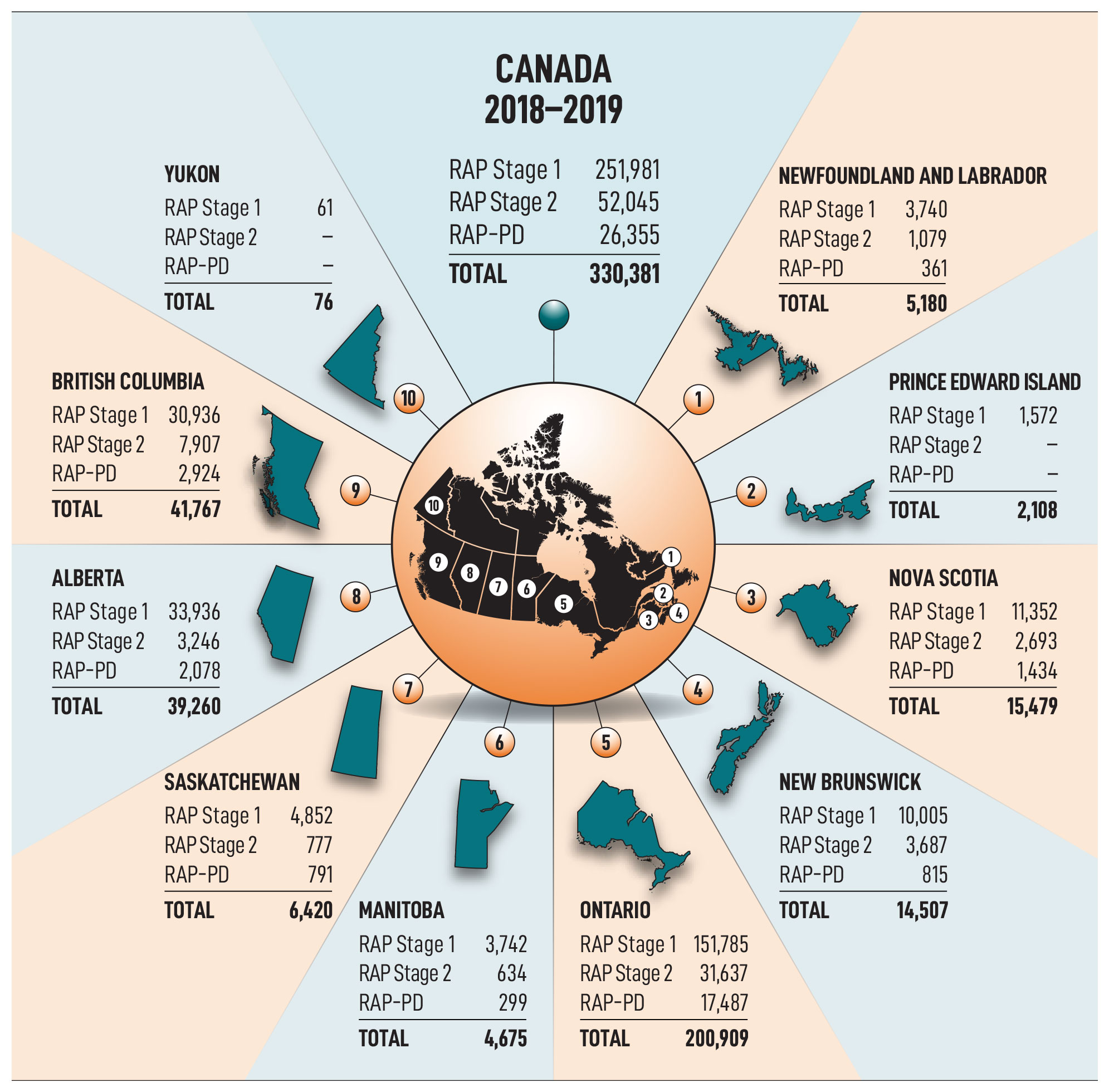

Canada Student Loans Program Annual Report 2016 To 2017 Canada Ca

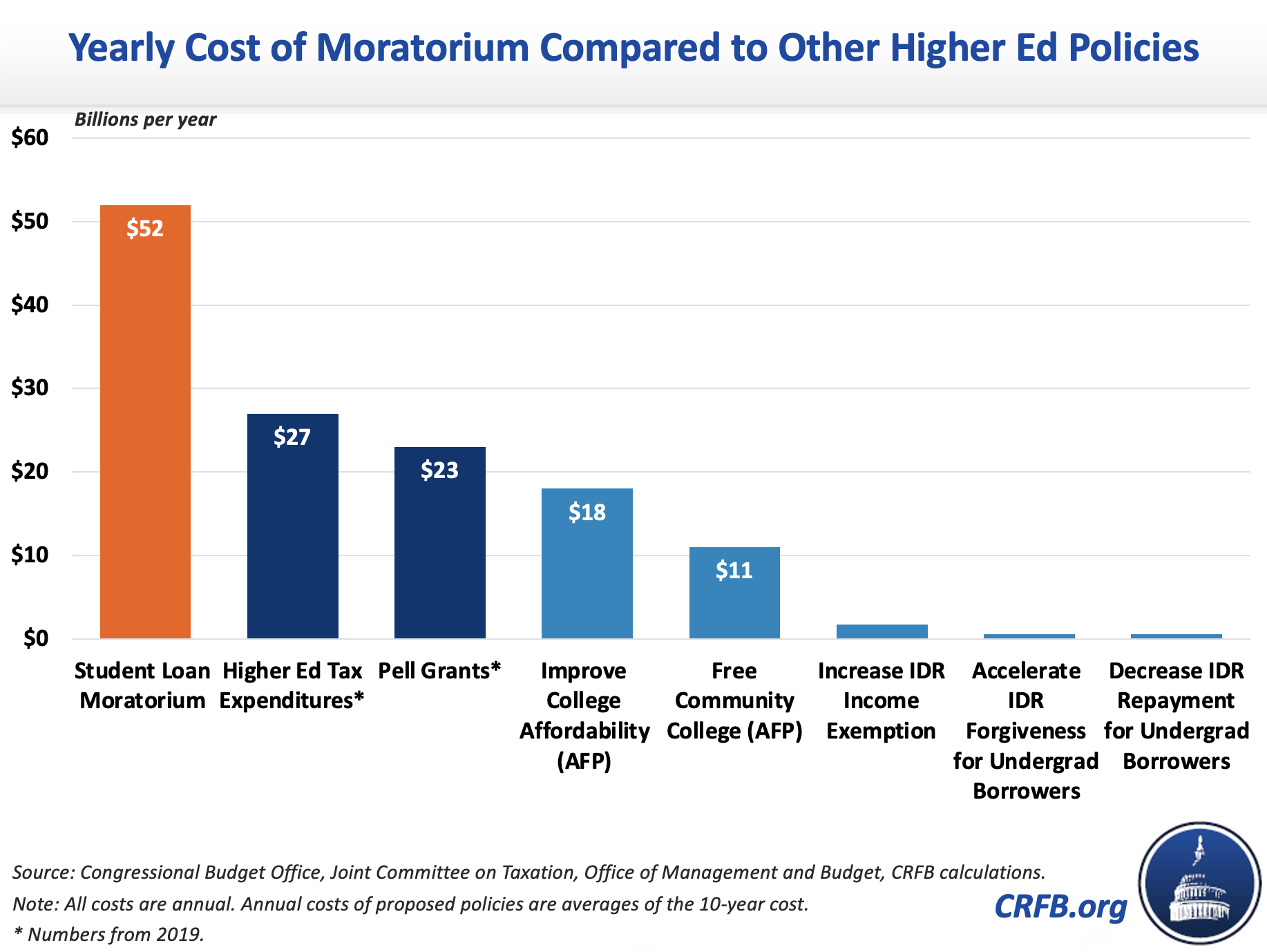

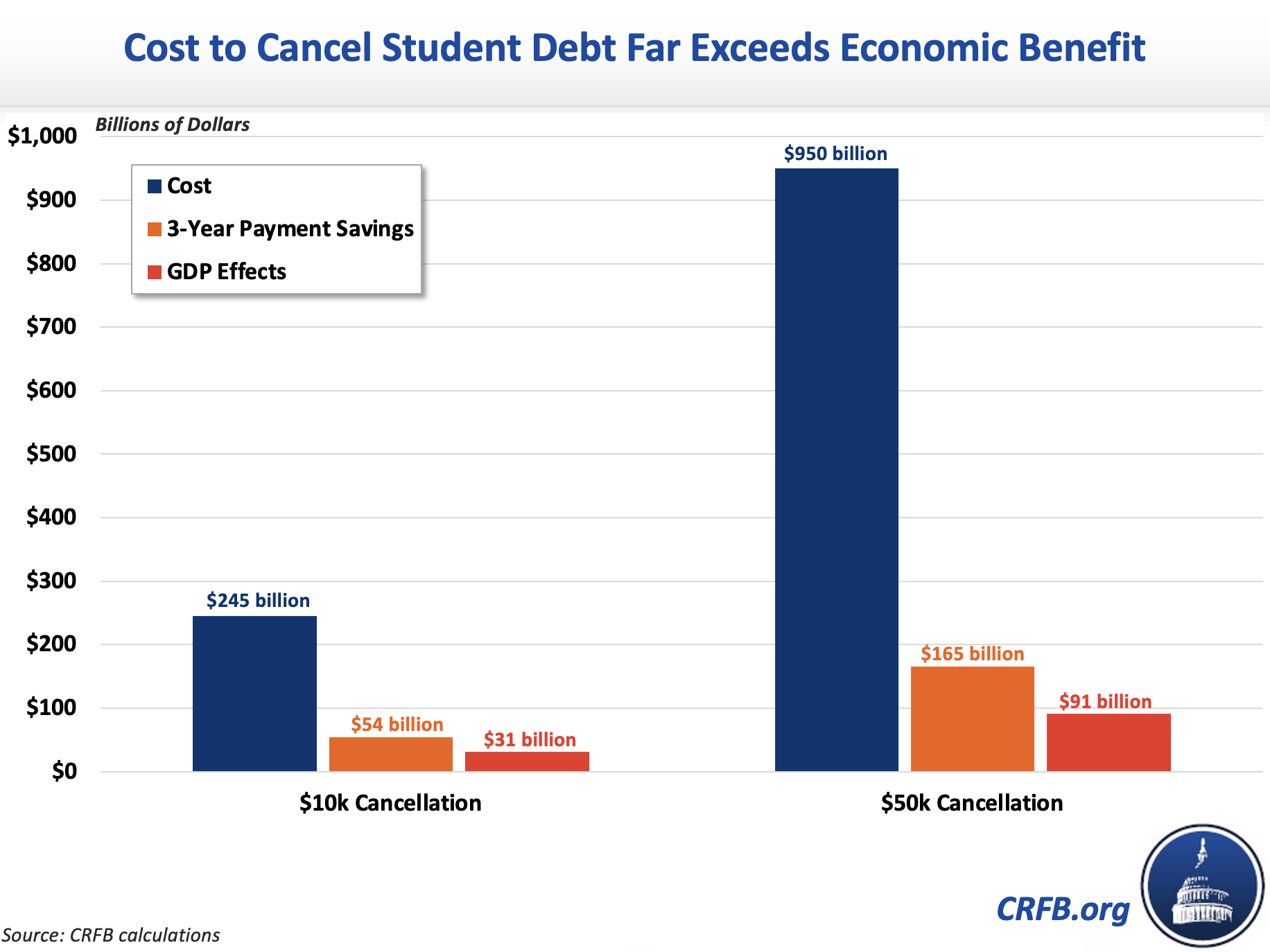

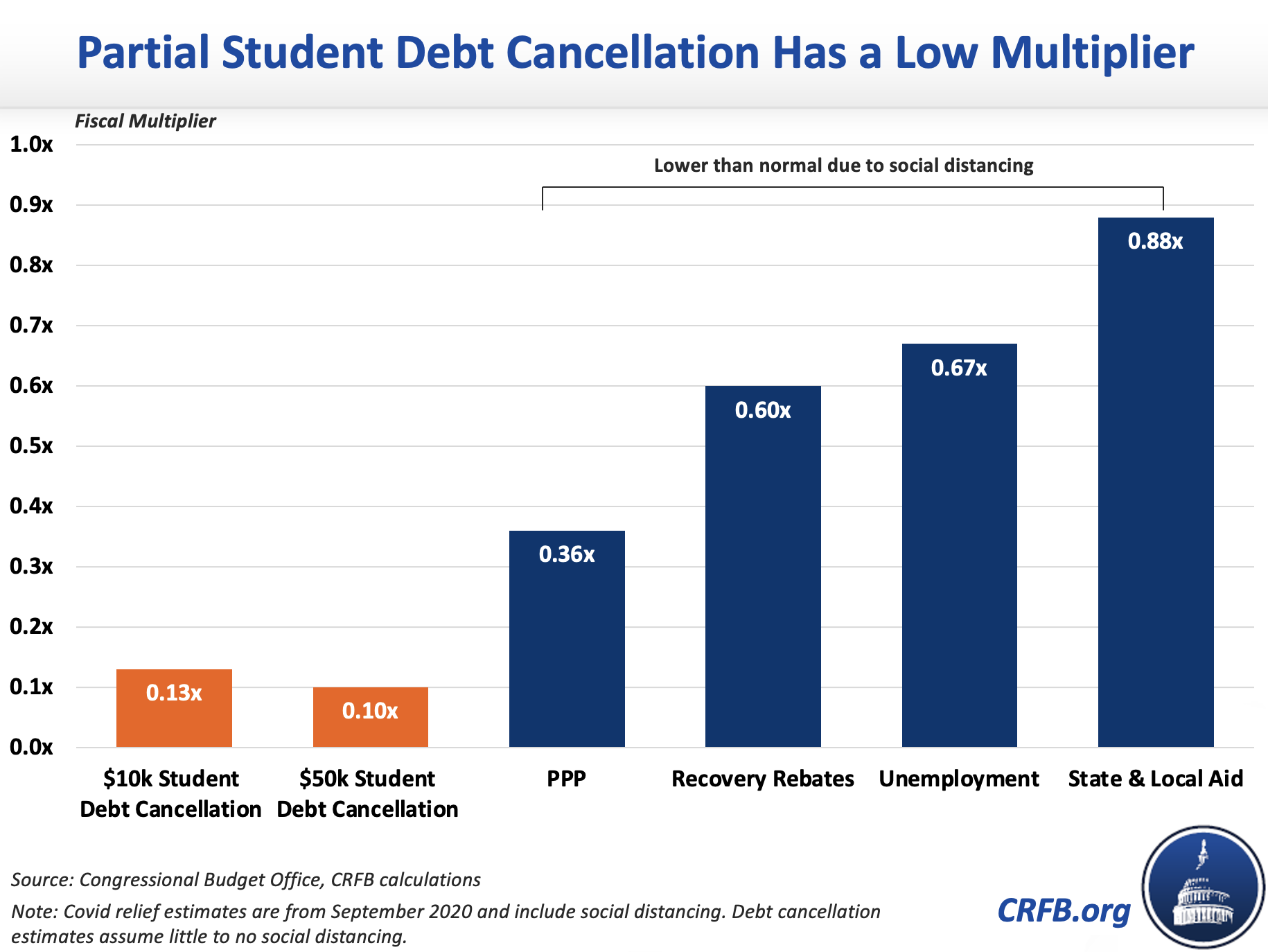

Partial Student Debt Cancellation Is Poor Economic Stimulus Committee For A Responsible Federal Budget

Canada Student Loans Program Annual Report 2018 To 2019 Canada Ca

Latest White House Plan Would Forgive 10 000 In Student Debt Per Borrower The Washington Post

2022 Tax And Rate Budgets City Of Hamilton Ontario Canada

Is There Tax Savings For The Interest On Student Loan Debt Consolidated Credit Ca

Student Loans The Racial Wealth Divide And Why We Need Full Student Debt Cancellation

Is There Tax Savings For The Interest On Student Loan Debt Consolidated Credit Ca

Student Loan Debt Statistics In 2021 A Record 1 7 Trillion

Fact Check Canceling Student Loan Debt Wouldn T Make Government Money

It S Time To Wind Down The Student Loan Moratorium Committee For A Responsible Federal Budget

Partial Student Debt Cancellation Is Poor Economic Stimulus Committee For A Responsible Federal Budget

Student Loan Debt Forgiveness In Canada Consolidated Credit Ca

Partial Student Debt Cancellation Is Poor Economic Stimulus Committee For A Responsible Federal Budget

20 Companies That Help Employees Pay Off Their Student Loans Student Loan Hero